Custom Insurance Software Development Services

Intellectsoft is a paramount global provider of software solutions for the insurance industry. We help the world’s insurance organizations to boost their efficiency, profitability, and safety through innovative digital transformation technologies.

INSURANCE SOFTWARE DEVELOPMENT SERVICES

Enhance your insurance software solutions and rely on our continuous digital innovation services to create greater organizational efficiencies, reduce costs, and provide a better end-user experience through time.

Our custom fintech solutions are built to offer a superior user experience while keeping your customer's data secure.

Intellectsoft insurance software development services offer the best-in-class quoting solutions to exceed end-users' and partners' needs and deliver high-quality results.

With automated workflows, our insurance industry experts allow agents to manage the claims process efficiently, quickly, and with the highest possible security level.

We offer customer-centered innovative insurance software development for modern insurers to build a value chain for their partners, customers, and vendors.

Our insurance software development services include mobile apps and chatbots to provide innovation and real added value for your business.

The promise of Big Data and analytics in the insurance industry brings hope for quick adaptation to modern information super-abundance.

Take full advantage of Intellectsoft's custom insurance software development capabilities to reach out to your clients across multiple channels and build strong relationships.

Get accurate records and seamless integration to automate many of the unique aspects of your insurance processes.

CUSTOM INSURANCE SOFTWARE DEVELOPMENT AND CONSULTING

Scale your delivery capacity with intelligent cooperation models.

TECHNOLOGY EXPERTISE OF THE INSURANCE SOFTWARE DEVELOPMENT COMPANY

Leading insurance carriers benefit from our professional services and methodologies that accelerate growth and impact the bottom line.

-

Legacy System

TransformationLegacy System TransformationModernize existing systems to meet rising customer demands for convenience and experience. Digitization enables insurers to manage Big Data and enhance claims handling mechanisms with the help of new data management infrastructure and machines.

-

Customer

ExperienceCustomer ExperienceTransforming the Customer Experience is a new and powerful shift for the Insurance domain that can bring about quantum change. Implementation of customer experience requires transforming traditional strategies, workflows, processes, and technologies.

-

Internet of

ThingsInternet of ThingsThe insurance business is predicated on data, and IoT provides volumes of data. IoT technology changes the way insurers assess, price, and limit risks, with a wide range of potential advantages and best insurance software solutions for the company.

-

Big

DataBig DataOur experts can bring you efficient insurance software solutions using a variety of Big Data development tools to help your organization achieve even the most ambitious goals.

-

Blockchain

BlockchainMore than 80% of insurance companies claimed they adopted or were planning to adopt blockchain technology. The need for innovation in insurance is critical — customers are craving transparency, speed, and cost flexibility.

-

Artificial

IntelligenceArtificial IntelligenceOur deep domain expertise enables insurers to become AI-driven and powered by automated machine learning. Artificial Intelligence in Insurance is already being used in many ways, from intelligent Chatbots that offer fast customer service round the clock to the array of machine learning technologies that improve insurance industry software solutions.

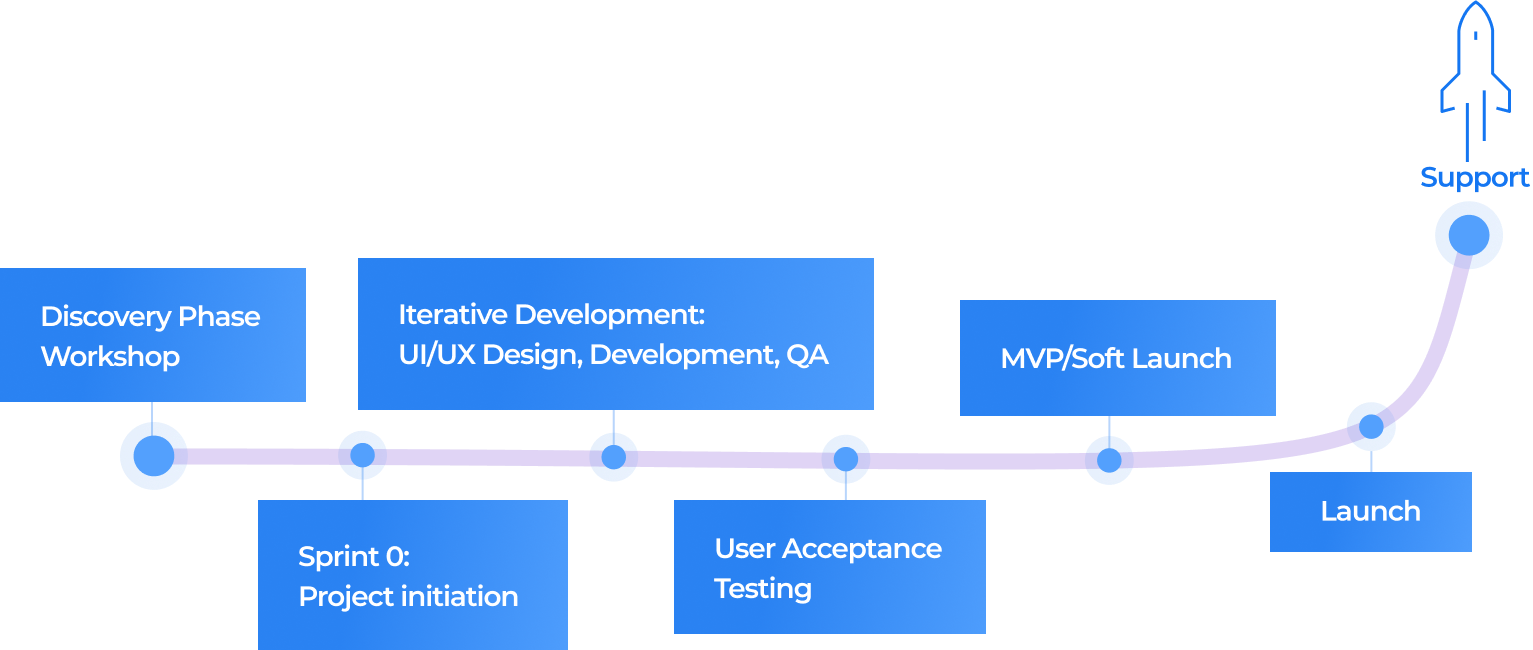

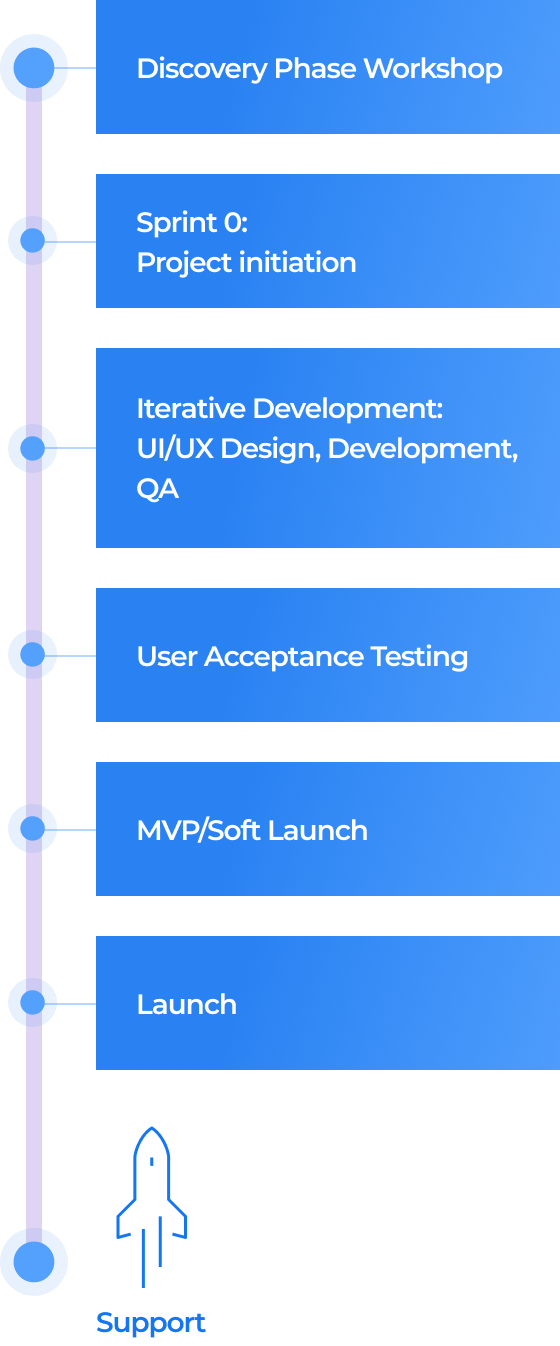

PROJECT DEVELOPMENT PROCESS FOR INSURANCE SOFTWARE SOLUTIONS

We provide full-cycle IT support, operational transformation, and high impact insurance software solutions that help insurance companies deliver personalized, efficient, and informed care.

- A shared understanding of project objectives

- Business requirements transformed into functional

- The initial vision of the architecture of the project

- A project plan that includes risks and budgets

- A clear product strategy and development roadmap

Download our CASE STUDY

Custom Cloud-Based Solution Helps Leading Insurance Provider Improves Customer Experience

Do you have additional questions?

What Is Insurtech Consulting?

Insuretch consulting is specialized in helping insurtech startups and mature technology solution providers to enter and expand market activities and technological possibilities in the best possible way.

How Is Maintenance of Legacy Insurance Systems Implemented?

Legacy insurance systems are shaking under the weight of innovation and involve potential disruption of existing services, additional costs for developing and migrating to new systems, and associated change management issues.

What Is Custom Insurance Underwriting Software?

Custom insurance underwriting software ensures quality insurance software solutions for improved internal process efficiency and reduced turn-around time.

What Is Custom Insurance Policy Management Software?

Custom insurance policy management software breaks down into two key processes:

• creating policies

• maintaining policies

Where to Hire Specialists for Custom Insurance Claim Management Software Development?

If you are looking for custom insurance claim management system developers then, you are in the right place. Intellectsoft is specialized in providing software development team services. Get quick, specific tech, and domain expertise acquisition.

What Are Six Steps to Consider Before Starting Insurance Mobile App Development?

There are six steps to take before creating an insurance mobile app of any complexity:

1) Do market research and analysis

2) Define your target audience

3) Determine whether it should be native, hybrid, or web application

4) Choose your monetization options

5) Create a marketing strategy, promotion plan, and plan for app store optimization

6) Take proper security measures

What Does Insurance API Development and Integration Mean?

Insurance API development and integration is the connection between applications, via their APIs, that lets those systems exchange data. Throughout many high-performing businesses, API integrations power processes keep data in sync, enhance productivity, and drive revenue.

What Does Insurance Quoting Software Development Stand for?

Insurance quoting is the amount of money that an insurance company calculates as the cost of providing insurance for something. One of the primary purposes of the insurance quoting software development process is eliminating paperwork and face-to-face contact.

What Does Insurance Compliance Software Development Mean?

Insurance compliance software enables insurance organizations and businesses to meet compliance regulations effectively. Insurance companies use compliance software to reduce non-compliance events, establish effective compliance processes, and maintain strict, auditable records for compliance officers.

What Is Insurance Risk Management Software Development?

Risk management software's primary purpose is to identify potential risks before they occur to plan risk handling activities, thus mitigating the adverse impact on achieving project objectives.

How Is Insurance Document Management Software Implemented?

Insurance Document Management Software empowers clients to streamline documents generated and received by organizing them in a single repository. This kind of software helps insurance companies to organize, manage, manipulate, and store data easily, resulting in better service for their customers and end-users.

What Do Insurance Agency Software Solutions Include?

Here is a list of possible insurance agency software solutions:

• Product & service reinvention

• Underwriting & claims automation

• Risk & document management solutions

• Modernized platforms & digital ecosystems

• Compliance & quoting software solutions

Contact Me

Thank you for your message!

We will get in touch with you regarding your request within one business day.

Send againWhat happens next?

- Our sales manager reaches you out within a few days after analyzing your business requirements

- Meanwhile, we sign an NDA to ensure the highest privacy level

- Our pre-sale manager presents project estimates and approximate timeline